As a foreign investor in Bali’s property market, one of your biggest questions is probably: What is the average Return on Investment (ROI) can I expect?

Knowing your ROI is key. It shows how profitable your property can be and helps you decide where to invest with confidence.

Now, we’ll show you how to figure out ROI on Bali investment property, including the key factors and how to estimate your payback period. Keep reading!

Key Takeaways

- Average ROI in Bali is around 7–12% per year, with prime areas reaching up to 20%.

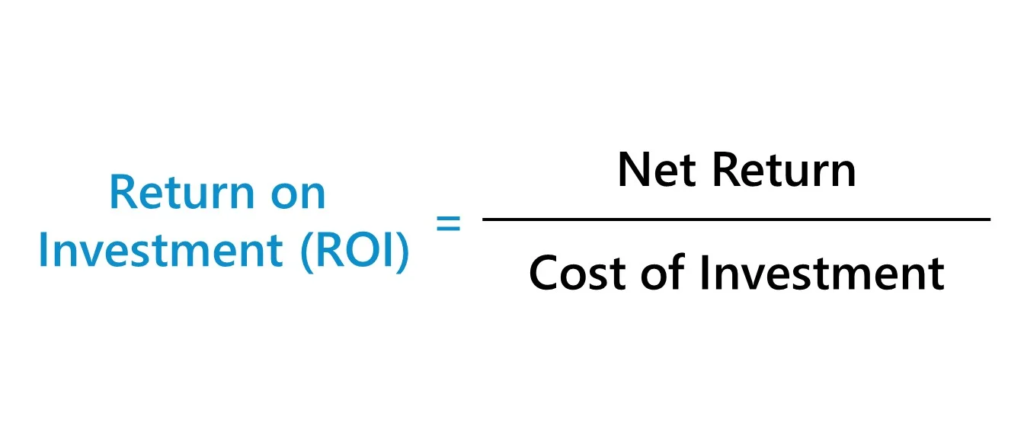

- The basic formula of ROI is: (Net Profit / Cost of Investment) x 100.

- The formula for long-term ROI is: ((New Value + Total Rental Profit – Initial Investment) / Initial Investment) × 100

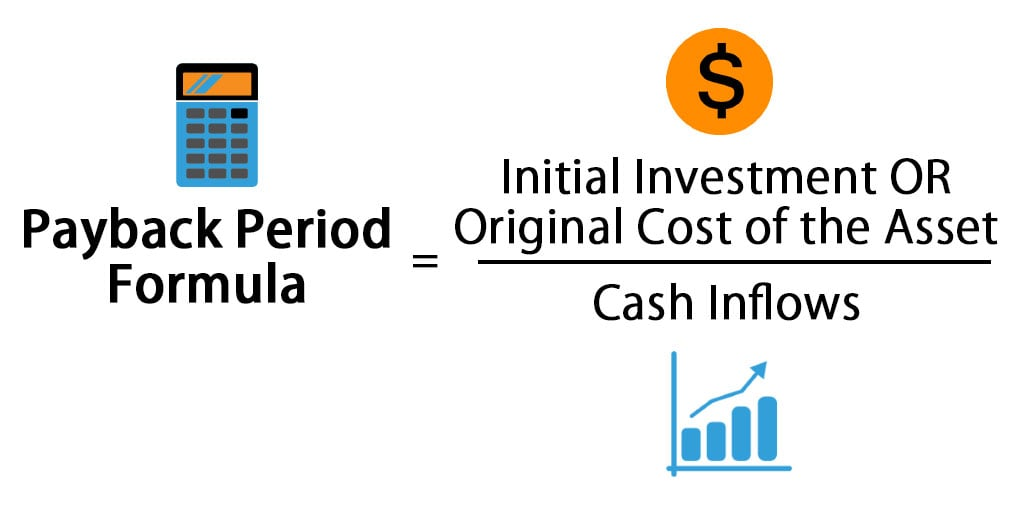

- Payback Period is a metric that indicates how long it will take to recover the cost of an investment. The formula is: Property Cost / Net Annual Income.

- Factors that influence ROI in Bali include location, property type, building materials, property management, rental rates, operating expenses, exchange rates, and purchase price.

Free Download: Bali Property Investment Guide 2025

What is ROI in Real Estate?

ROI, or Return on Investment, is a way to see how much money you can make compared to what you spend. It’s a simple measure people use in all kinds of businesses, and it’s especially important in real estate.

When you buy property, ROI helps you understand what you’ll get back after covering all costs like purchase, maintenance, and other expenses.

Knowing your ROI makes it easier to compare different opportunities, plan smarter, and choose the property that gives you the best profit.

What Is the Average ROI for Bali Investors?

For investors, having clear ROI numbers is key. From our experience and industry data, here’s what you can expect in Bali’s property market:

- Average ROI: 7–12% per year

- Higher Potential Returns: Up to 20% (in premium areas)

- Rental Yields: Around 5–10% annually

- Property Value Growth: Typically 5–10% per year

How to Figure ROI on Investment Property Bali

The basic ROI formula is: ROI = (Net Profit / Cost of Investment) x 100

For a rental property, you can calculate it this way: ROI = ((Annual Rental Income – Annual Expenses) / Property Cost) x 100

Pro Tips: Try Our ROI Calculator for Free

Real Estate ROI Example

Disclaimer: The figures shown are examples only and are used for illustration purposes to demonstrate ROI calculations. Actual results may differ in real scenarios.

Imagine you purchase a villa in Canggu for $300,000. Each year, it generates about $3,000 per month in rental income, which adds up to $36,000 annually.

Now, let’s say your yearly expenses—like property management, maintenance, and taxes—come to $6,000.

Your ROI calculation looks like this: ROI = (($36,000 – $6,000) / $300,000) x 100 = 10%

That means you’re earning a 10% annual return, a healthy yield for Bali’s property market.

Long-Term Real Estate ROI Considerations

Now, what about the long-term return on investment? If you’re interested in investing in Bali property for the long run (let’s say, more than 5 years), there are several factors to consider.

1. Property Appreciation

In popular areas in Bali, property values can increase by about 10-20% per year. This increase can greatly improve your long-term ROI, especially if you plan to sell the property after a few years.

2. Increasing Rental Rates

Over time, the demand for rental properties can increase, allowing you to raise rental rates. This increase can boost your annual rental income and overall ROI.

3. Major Renovation Needs

Major renovations might be necessary every 5-10 years to keep the property attractive to renters. While these renovations increase costs, they can also justify higher rental rates.

Read More: 6 Smart Strategies to Boost ROI on Your Bali Investment Properties

Long-Term ROI Example

Disclaimer: The figures shown are examples only and are used for illustration purposes to demonstrate ROI calculations. Actual results may differ in real scenarios.

Here’s how to figure out ROI on investment property (for long-term investment):

- Initial Property Value: $300,000 (implied from previous example)

- Appreciation: 15% over 5 years

- New Value after 5 years: $345,000

- Total Rental Profit over 5 years: $150,000

The Total Return on Investment (ROI) calculation is as follows:

Total ROI = ((New Value + Total Rental Profit – Initial Investment) / Initial Investment) × 100

Plugging in the values: Total ROI = ((345,000 + 150,000 – 300,000) / 300,000) × 100 = (195,000 / 300,000) × 100 = 0.65 × 100 = 65% over 5 years

This translates to about 13% per year, as you’ve noted.

This calculation provides a comprehensive view of the investment’s performance, considering the property’s appreciation and income generated through rentals.

Get a Customized Investment Plan in Bali

With over 12+ years in the market, here’s what we can do for you:

- Find the best location to invest in Bali.

- Reliable guidance on Bali’s property market and laws.

- Personalized strategy to maximize returns and meet your financial goals.

Payback Period

The Payback Period is a metric that indicates how long it will take to recover the cost of an investment.

The formula for Payback Period is: Payback Period = Property Cost / Net Annual Income

Net Annual Income is calculated by subtracting annual expenses from annual revenue.

Payback Period Calculation Example

Disclaimer: The figures shown are examples only and are used for illustration purposes to demonstrate ROI calculations. Actual results may differ in real scenarios.

Imagine you buy a villa in Bali for $300,000. Each year, it brings in $36,000 in rental income. After covering expenses like maintenance, taxes, and management (around $6,000), your net income comes to $30,000 per year.

Now, if we apply the payback period formula: Payback Period = $300,000 / $30,000 = 10 years

This means that assuming consistent income and expenses, it would take 10 years for the net income from the property to equal its purchase price.

Factors Influencing ROI in Bali

1. Location

Properties in popular areas like Seminyak or Canggu might cost more but can also bring in higher rental income. High-demand areas attract more tourists, leading to higher occupancy rates and rental income.

2. Property Type

The type of property can impact profitability and vacancy rate. To maximize the revenue potential, your property must meet market demand, such as building design, material quality, and number of bedrooms.

3. Building Materials

The quality of the materials used to build your property will significantly impact attracting clients and reducing short- and long-term maintenance costs.

4. Property Management

Good management can increase the frequency of your property’s rental and allow you to charge higher rental prices. Efficient property management keeps the property well-maintained, attracting and keeping tenants.

5. Exchange Rates

Since you are likely investing in USD but earning in Indonesian Rupiah (IDR), exchange rates can affect your actual returns. Changes in currency exchange rates can impact your investment’s profitability.

6. Purchase Price

The purchase price has a significant impact on ROI. It’s important to pay the right price for the property based on its location, income potential, and operation and maintenance cost minimization.

Read More: Cost of Property in Bali: What You Need to Know (2025)

7. Rental Rates

Rental rates drive a property’s top-line income. It’s very important to price your property correctly to be competitive and maximize occupancy. Any change in rental rates, up or down, will have a material impact on ROI.

8. Operating Expenses

Operating expenses have a major impact on ROI. Properties with high expense levels will produce less ROI than ones that are run very efficiently.

9. Vacancy

The property’s occupancy level also impacts ROI because it drives rental income. The location, property type, and rental rates will significantly affect the vacancy rate.

FAQ

Yes. Smaller villas can bring 8–10% rental yields plus steady value growth. Popular areas like Canggu and Uluwatu often reach 85% occupancy, making them strong picks for investors.

Around 50–75% over five years is considered reasonable.

Yes. Villas in Bali can deliver high rental income and long-term value growth.

ROI measures the percentage return you earn from a rental property after covering all expenses, but it doesn’t factor in taxes. It simply compares the money you invest with the rental income you receive each year.

Conclusion

From what we’ve seen with our clients (and the industry reports back us up), the acceptable ROI for Bali property investors is usually around 7–12% a year.

In the best spot, with strong demand and great villa features, that number can even climb up to 20%. Pretty exciting, right?

But here’s the thing—ROI isn’t the only piece of the puzzle. You’ll also want to think about how you plan to use the property, long-term market trends, and your overall investment goals.

The smartest move? Talk with local experts and financial advisors who know the Bali market inside out. They’ll help you figure out what’s realistic for your situation.

With a solid plan and a clear strategy, you’ll be in a great position to make your Bali investment work for you.